Fully configure your own OTP setup with our Business Messaging API to match your needs. Full freedom in the selection of channels & messages.

Contact us to get startedBy combining our OTP API with our Business Messaging API you have complete freedom in sending OTP codes by offering a seamless customer journey using one or more customized channels of choice.

Contact to get startedIf you want to get started right away you can use SOLiD, our full-service OTP service. We create, verify and deliver your OTP messages taking care of the full end-to-end process.

Contact to get startedReach your customers wherever they are with One Time Passwords on SMS. Even when users don't have access to the internet, they can still make use of this multi-factor authentication solution.

WhatsApp messages are encrypted from end to end, making WhatsApp Business a popular choice for sending One Time Passwords. You do need to have an opt-in before you can send them an OTP.

Did your customers already adopt your own native app? Then you can also integrate and enable two-factor authentication via push notifications within your own app.

One Time Passwords over Voice will allow you to reach users with limited sight, without mobile phones, or destinations that are not reachable by SMS, in different languages.

One Time Passwords via email are always an accessible option. Customers, who feel uneasy about sharing personal information, will often prefer receiving OTPs over email.

One Time Passwords provide a superior level of security while minimizing inconvenience for clients in the financial industry. OTPs offer a robust authentication method, meeting the customer's high expectations for data privacy.

Read moreIn the healthcare industry, data breaches often aim to exploit healthcare employees' user credentials as a gateway to sensitive systems. To prioritize security, an extra layer of protection via One Time Passwords helps safeguard valuable healthcare data.

Read moreCombatting eCommerce fraud is crucial, and One Time Passwords serve as an effective solution for online accounts. By integrating this security measure, customers gain confidence in the protection of their personal information.

Read moreGovernment employees possess access to critical data, making them prime targets for attacks. Implementing One Time Passwords ensures that only authorized users can access government data, providing an essential layer of security against unauthorized access.

Read moreFast delivery of time-critical messages are guaranteed

Our platform is connected to 2000 operators worldwide

Rely on our ISO 27001 certified redundant platform

Benefit from our round-the-clock and in-house support

Get clear control and insights on your costs and traffic

| Configure Your Own OTP | OTP-as-a-Service | |

|---|---|---|

| Configure Your Own OTP | OTP-as-a-Service | |

Branding |

Custom branding |

SOLiD branding |

Price per verified OTP * |

Starting at € 0.04 |

Starting at € 0.04 |

One-time setup costs per channel ** |

€ 199,- per channel |

Included |

Template update ** |

€ 49,- per update |

Included |

* Excluding channel costs (conversational channels and SMS) per OTP sent. Standard prices: Go - €0.04 | Basic - €0.03 | Advanced - €0.025 | Pro - €0.02

** Required if custom branding is applicable. SMS is excluded from the one-time setup costs and template updates.

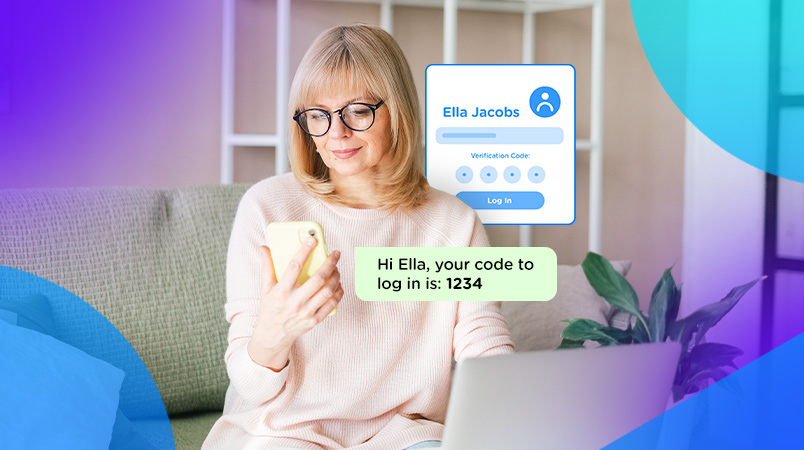

A One Time Password or OTP is a security code designed to be used for a single login attempt, to minimize the risk of fraudulent login attempts and maintain high security. It’s a string of characters or numbers automatically generated and sent to the user’s phone via SMS, Voice, or Push message.

The OTP has become the standard method worldwide of enabling a login when special circumstances apply, such as validating a new account or confirming a transaction is legitimate.

Providers like CM.com offer OTPs as a service, with a secure platform for receiving or initiating OTP requests, sending the OTP as a text or other channel, and verifying the OTP was entered correctly, so the transaction can go ahead.

The infrastructure for making use of one-time passwords integrates with your website or application using an API. This is how a site “knows” whether an entered OTP is correct or not, with safeguards like checking it’s within the time window.

There are several ways to send an OTP. Some give the option of receiving OTPs by email, although this tends to be less secure. Other providers even enable OTPs as voicemails, stating the PIN aloud when the customer checks the mailbox.

But by far the most common way to send OTPs is by Push or text messaging, typically an SMS or even WhatsApp message to the customer’s mobile phone.

Read moreAn OTP is generated automatically as a semi-random number or string of characters. There is no way to predict what the OTP will be ahead of time. OTPs are valid for a single login session or transaction, enhancing security by reducing the risk of unauthorized access even if the password is intercepted. Once used, the OTP expires, ensuring it cannot be reused for future logins or transactions.

In the current digital era, technological and online advances are rapidly growing, creating new ways for businesses to engage their customers. Unfortunately, where there is growth, there will be criminals trying to steal some of the profits. Protecting business data, customer information, and online accounts is a priority for every modern business. SMS security can help protect your business and your customers from online fraud and cyber crime.

In today's interconnected world, the importance of robust digital security cannot be overstated. As businesses and individuals grapple with increasing cyber threats, the choice of security measures becomes crucial.

Enhancing platform security and implementing Two-Factor Authentication (2FA) processes are crucial for organizations to protect business and customer data. However, these security measures only work when employees and customers are willing to adopt and adhere to them. So, how can your business ensure employee and customer adoption? In this blog, we'll dive into Two-Factor Authentication (2FA), its benefits and best practices to ensure adoption.

Chances are that you've received One Time Passwords (OTPs) before, often via SMS or email. But did you know that there might be an even better platform to send OTPs on? WhatsApp Business Platform allows you to send One Time Passwords on the favorite messaging channel of your customers, enhancing the customer experience and improving customer relations.

Two Factor Authentication, or 2FA, is an effective way to protect your data and your customers. But how do you set up Two Factor Authentication? And what messaging channels can be used for 2FA?

Protecting customer data is (or should be) a priority for every modern business. One of the most secure ways to verify customer information is by multi-factor authentication (MFA). In this blog, we’ll discuss the top benefits of MFA (and 2FA) and explain why it’s a must-have for mobile-native businesses.

Multi-factor authentication, or MFA, is one of the most effective ways for businesses to protect their systems and customers’ online accounts from hacking, spamming, data theft, and more. Let’s take a look at some common multi-factor authentication use cases in high-risk industries that could benefit from using MFA in their security protocols.

Select a region to show relevant information. This may change the language.